At REFINERI, we operate in two different countries as of now: United Kingdom and Turkiye. Naturally, when it comes to defining our agreement with anyone who wants to join our network and collaborate with us, we leverage our international structure to provide all the options that we can. We want to make sure everyone can find the one that fits their needs and is the most beneficial for them.

If you are currently residing in Turkiye, you can opt to become either a permanent employee with REFINERI Turkiye or an independent contractor with REFINERI UK. No matter which agreement you choose to go with, your working hours, roles and responsibilities, or the projects to which you contribute will be the same. Nevertheless, each agreement type defines a distinct legal relationship that entails different sets of rights and payment structures, as well as unique advantages. Anyone who completes our onboarding process successfully is free to choose the alternative they prefer.

In this article, we want to walk you through each of the two agreement types, so that you have access to all the information you need and can make an informed decision about which one suits you better.

- Employment with REFINERI Turkiye

This option is quite straightforward and familiar for anyone who has signed an indefinite employment agreement with a company that operates under the legal jurisdiction of Turkiye. It is the standard working model, all rights and regulations of which are detailed within the labour act numbered 4857.

If you wish to do so, we will together sign an indefinite employment agreement as such. We determine the salaries of our employees according to the value of the British Pound Sterling (Abbreviated GBP). It usually hovers around 1.35 USD, so you can assume that 3 GBP roughly equals 4 USD if you’re not familiar with its value. We are, however, required by laws and regulations to make the actual salary payments in Turkish Lira (Abbreviated TRY). Exchange rates are updated every 3 months according to the market and each update is shared with our employees ahead of time.

At REFINERI, one of our core values is transparency. It defines not only our relationship with clients and our methodologies but also the culture we’re putting forward among our collaborators and employees. We outright reject toxic work environments where employees are encouraged to keep their rights and salaries to themselves, and competitively pitted against each other. Collaboration is the name of the game here, and let alone knowing everyone’s salary being a fireable offence, we openly share the net salaries for each experience level.

Here are the net salaries we have designated for our permanent employees for the year 2022:

- Junior-level Developer: 700 GBP

- Mid-level Developer: 1000 GBP

- Senior-level Developer: 1500 GBP

- Lead-level Developer: 2200 GBP

Besides this salary and rights guaranteed by labour laws, we also offer some side benefits to our employees:

- Monthly remote-working support worth 500 TRY or a Workinton coworking space membership that lets you work from any of their office spaces.

- Complementary Health Insurance

- Monthly food support worth 1000 TRY

We constantly strive to offer our collaborators the best living standards that we can and aim to improve and add to these side benefits in the future.

2. Being an Independent Contractor with REFINERI UK

The other option we offer to candidates who want to collaborate with us is that they establish a personal (şahıs şirketi) or a limited company (if they don’t have one already) and then enter into an agreement with REFINERI UK through that company.

An agreement as such defines a relationship between two independent companies instead of one between an employer and an employee and includes the details of the services to be provided. Therefore, if you wish to go with this option, you will be designated as a “service provider” or a “solution partner” with REFINERI.

First and foremost, instead of paying a net salary, we make direct payments as remuneration for the services you provide. To be able to do that, we require our service providers to invoice us at the end of each working month according to their daily rate and the number of days that they have worked. We then send the corresponding payment in GBP to their bank account at the due date of the invoice. The thing to note here is that, unlike the net salary payments for our employees, this income that our service providers will derive annually is subject to taxation. We will give the details regarding the net income our providers can expect in the following sections, so be sure to keep reading if you want to have a direct comparison with being a salaried employee.

Besides the differences in payment, legally we’re not allowed to offer our service providers the same complementary benefits we give to our employees. Nonetheless, some of the expenses you incur while working with us are billable in your invoices, such as the working space that you might need while working from your home or a Workinton space.

The most substantial advantage of working for us as a service provider, despite not having some of the rights and complementary benefits, is the drastic difference in compensation and rates: you will be earning a lot more than your salaried employee counterparts. This working model, while not being that common in Turkiye, is quite prevalent in many other countries and sectors, and is referred to as being a “Contractor”. Independent contractors work with their own equipment, and have full control over their off-time and holidays without needing to seek approval from a supervisor. It’s akin to being a freelancer in some ways, and you could find a lot more resources on the internet about its unique advantages beyond this article.

Here are the daily rates we have designated for our service providers for the year 2022:

- Junior-level Developer: 90 GBP per day

- Mid-level Developer: 120 GBP per day

- Senior-level Developer: 180 GBP per day

- Lead-level Developer: 270 GBP per day

Taxation and Expected Net Income For an Independent Contractor

The purpose of this section is to familiarise you with the independent contractor working model. It is only to give you a base expectation regarding your net income if you choose to become one, and it does not implicate any legal commitment from our side. If it contains out of date, missing or erroneous information, we can’t accept any responsibility and we encourage you to discuss these matters, be it the responsibilities that come with it or the additional advantages, with your accountants in detail.

Personal or limited liability companies are subject to expenses, taxes, and payments such as withholding tax (Stopaj), insurance (Bağ-Kur), stamp duty (Damga vergisi), or mandatory accountant and financial advisors (Zorunlu Mali Müşavir). These are relatively insignificant expenses in view of the daily rates we’re offering and we encourage you to do your own research and get advice from an accountant about them. In this section, we’re mostly going to talk about how to calculate your expected personal net income, the income tax you might pay, and most importantly, the advantages regarding the Turkish government’s income tax subsidy program for software development exporters.

In the following calculation, we will use as our example an independent contractor who provides senior level software development services and operates through their personal company. To get an accurate estimation regarding income for the other service levels, you can follow the same steps.

- We mentioned that our senior level service providers have a daily rate of 180 GBP. Let’s imagine that this service provider billed us for a total of 235 working days throughout the year. As a result, in accumulation, they have billed us for the value of 42.300 GBP.

- At the moment we’re typing this, 1 GBP is equivalent to 18.42 TRY. If we assume your company had no other income during this same period, this will correspond to a total income of 778.724 in TRY.

- The expenses that you incur while working for your company such as food, equipment, travel or communication can be added as a company expense as well. These costs will vary from company to company and person to person, but let’s assume that the company in question has stated a total of 28.724 TRY as expenses for the year. This will make the final profit for the company 750.000 TRY.

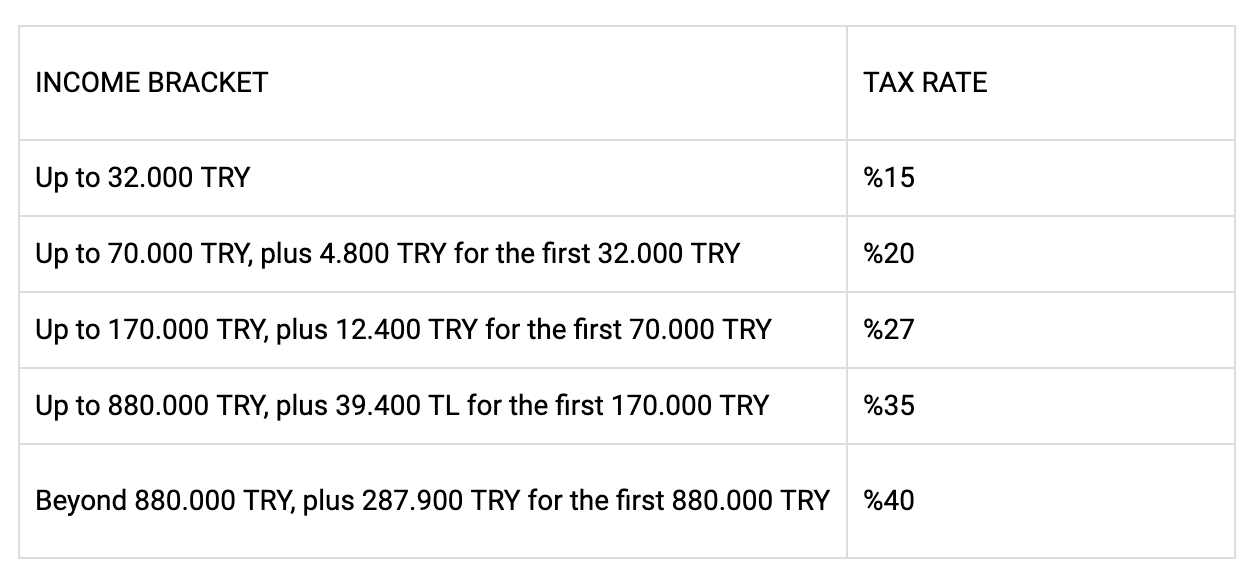

- The following table details the income tax brackets for personal companies. The company in our example is exporting software related services to REFINERI UK and is therefore eligible for a substantial %50 income tax advantage. This means that instead of the 750.000 TRY which represents the actual profit, this company will be taxed only for the half of this value which is 375.000 TRY.

According to these tax brackets, the total income tax for this service provider for the year will be 111.150 TRY. Note that if it wasn’t for the software export subsidy, it would have been 242.400 TRY. If we subtract this value from the total income of 750.000 TRY, that leaves us with a net profit of 638.850 TRY for the year. This net annual profit corresponds to a monthly net profit of 53.238 TRY. If you prefer, you can also consider including to this net profit the expenses you personally incurred while providing these services (28.724 TRY in our example), since most of those expenses would have been incurred by and for you if you were a personal employee as well. In that case, we reach a final net monthly income of 55.631 TRY for this service provider.

Finally, let’s note that for companies exporting their services to international markets, their income won’t be subject to value added tax (KDV).

We certainly hope that this article has clarified any questions that you might have regarding your collaboration options with us. But if you still have questions, please don’t hesitate to reach out through contact@refineri.co.uk.